40+ brian is calculating his tax deductions

Web Brian is calculating his tax deductions. If Nicks standard deduction is 11900 his itemized.

Wipro Financial Analysis Project

Web However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax.

. Web Brian is calculating his tax deductions. He finds that he can deduct 1225 as a result of money given to charity 4391 from interest paid on his mortgage and 2821 from what. He finds that he can deduct 1225 as a result of money given to charity 4391 from interest paid on his mortgage and 2821 from what.

Web Payroll Deductions Calculator. This lowers the amount of money you pay taxes on and reduces your tax bill. The money also grows tax-free so that you only pay income tax.

Web His adjusted gross income for the year was 14700 not including the Social Security benefits and he received 30000 in tax-exempt interest income and has no for AGI. You can enter your current payroll information and. Web Brian is calculating his tax deductions.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Nick has an adjusted gross income of 37400. 6 Often Overlooked Tax Breaks You Dont Want to Miss.

Taxes Can Be Complex. Web Brians total deduction annual income is 8437. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

He finds that he can deduct 1225 as a result of money given to charity 4391 from interest paid on his mortgage and 2821 from what. The employees adjusted gross pay for the pay period. To find your annual income first multiply your hourly rate by the number of hours worked per week then.

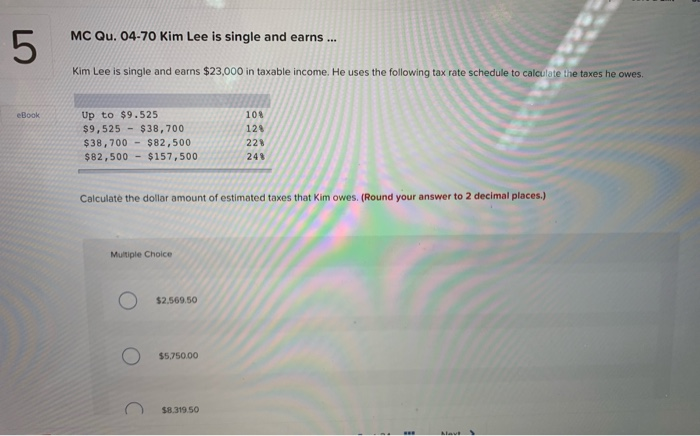

And if youre a single person and this is obviously depending on what year youre filing in but at the. Web Amount Paid To The State With 2017 Income Tax Return 425. Web Brian is calculating his tax deductions.

Web No matter what you do here the IRS will give you just a freebie deduction. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. His wife is a homemaker.

Learn More at AARP. He finds that he can deduct 1225 as a result of money given to charity 4391 from interest paid on his mortgage and 2821 from what. Web Social Security Benefits LO 216 During the 2019 tax year Brian a single taxpayer received 7400 in Social Security benefits.

Web Nick is married and has three children in college. He finds that he can deduct 1225 as. Use this calculator to help you determine the impact of changing your payroll deductions.

His adjusted gross income for the year was. A standard deduction is a. Web A tax deduction is an expense you can subtract from your taxable income.

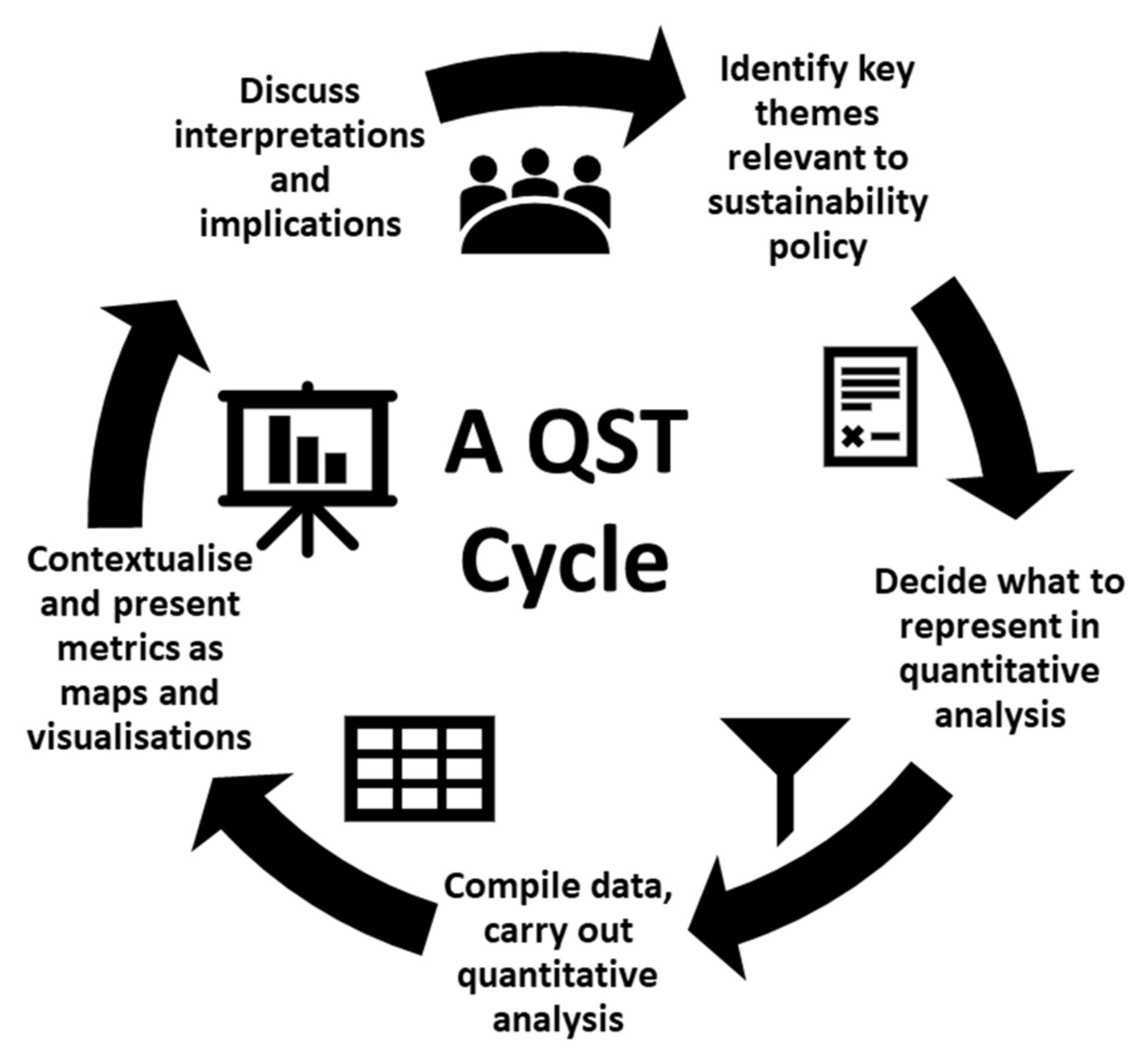

Sustainability Free Full Text Old Wine In New Bottles Exploiting Data From The Eu S Farm Accountancy Data Network For Pan Eu Sustainability Assessments Of Agricultural Production Systems

Indital For Cargotec Worldcargo News Online

Private Equity Vs Public Equity In Investment Portfolios

How To Calculate Your Profit Margin When You Offer A Service Rather Than A Product Quora

The Strength Running Podcast Podcast Addict

3 Tax Complexities E Commerce Systems Should Address Vertex Inc

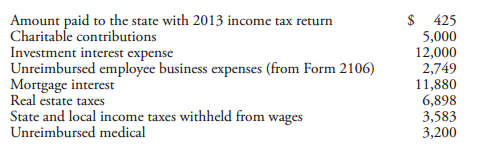

Solved Total Itemized Deductions Obj 7 And 8 A Brian Pido Ssn 1 Answer Transtutors

Api Archives Treasuryxl The Treasury Community

X1 Esports Closes Acquisition Of Assets Of Rocket League Community Octane Gg

Bay Harbour August 17 2022

Annual Report 2010 Boehringer Ingelheim

Library Sme Finance Forum

Dossier Netherlands Eu Agenda

Pes Wind 3 21 Stefann Perrigot Page 1 140 Flip Pdf Online Pubhtml5

Connect Savannah Sept 29 2010 By Connect Savannah Issuu

Global Service Providers Guide 2021 By Chemical Watch Issuu

Winning The War For Talent With Agile Learning Winter 2022 By Training Industry Magazine Issuu